With the global lending market projected to reach $8.82 trillion by 2025 (Source: Allied Market Research), lending institutions face increasing pressure to streamline loan processes and provide seamless customer experiences. Managing loan inquiries, processing applications, and ensuring timely follow-ups are crucial to driving business success. Imprint, our comprehensive field force management solution, optimizes the entire lending lifecycle—from lead capture to loan disbursement—ensuring efficiency, reducing operational costs, and improving borrower satisfaction.

Imprint empowers lenders by automating key processes, tracking real-time field activities, and enhancing communication with borrowers. Whether capturing loan inquiries from multiple channels or enabling dynamic loan approvals, Imprint is designed to meet the unique needs of lending institutions and enhance their bottom line. Below is a step-by-step breakdown of how Imprint revolutionizes lending management:

How Imprint Transforms the Lending Process

Complete Loan Inquiry Capture

Effortlessly capture loan inquiries from various sources, including social media, phone, email, and your website. Imprint automates the screening process, ensuring your team focuses only on high-potential leads, improving overall lead quality.

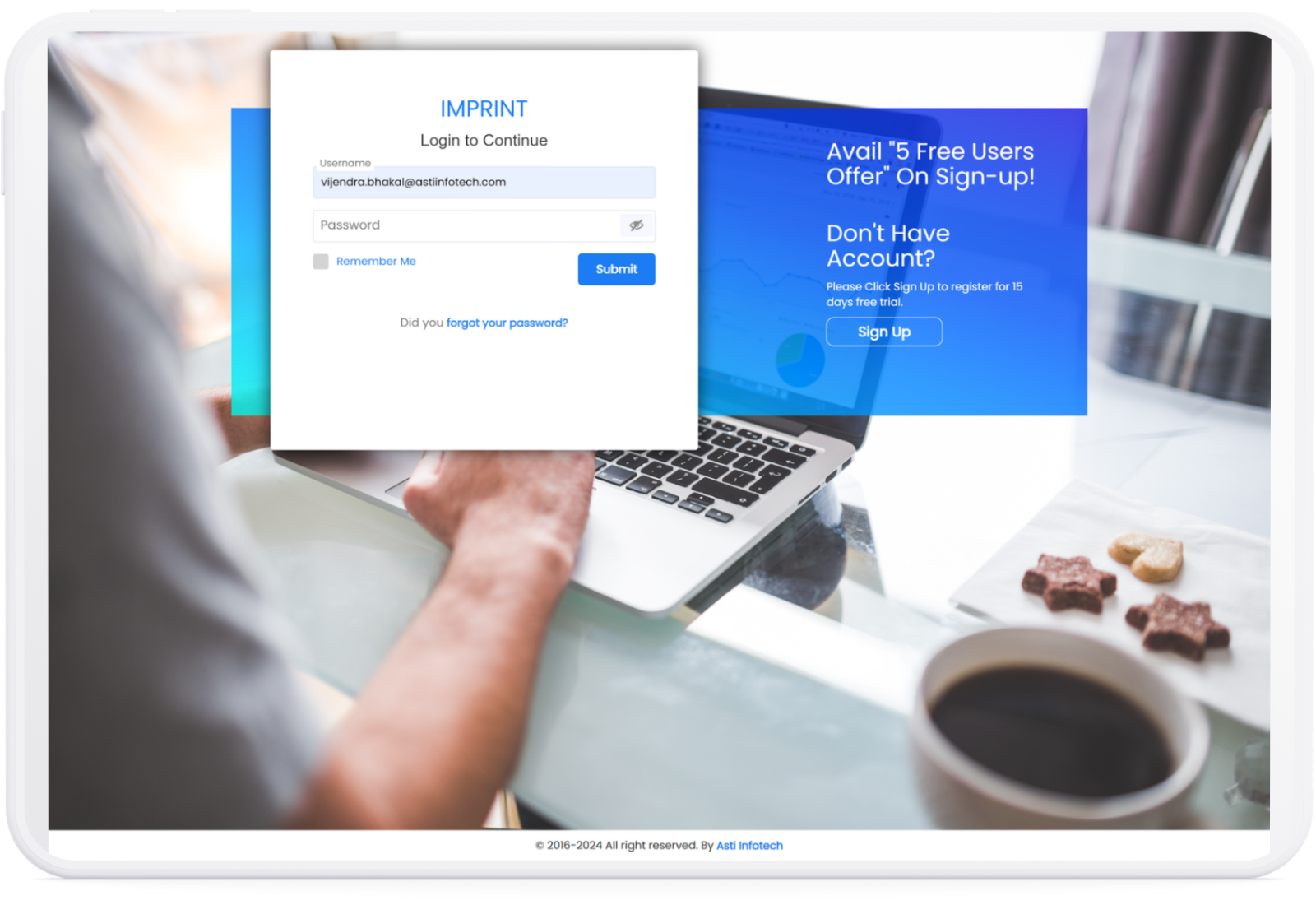

Self-Serve Application Form

Offer borrowers a seamless experience with a mobile-optimized self-serve application form. Verified via OTP, this process ensures accuracy in contact details, reducing errors from the start.

Self-Serve Lending Portal

Allow borrowers to manage their applications independently through a self-serve portal. From identification verification to document uploads and application tracking, borrowers enjoy full transparency and control over their loan process.

End-to-End Application Processing

Imprint provides a frictionless, end-to-end digital experience, guiding borrowers through the loan application journey smoothly, ensuring minimal manual intervention and faster loan approval times.

Automated Pre-Screening Checks

Integrate with your Loan Origination System (LOS) and other tools to automate pre-screening checks. By validating borrower data, Imprint enhances funnel quality, accelerates loan processing, and ensures timely loan disbursement.

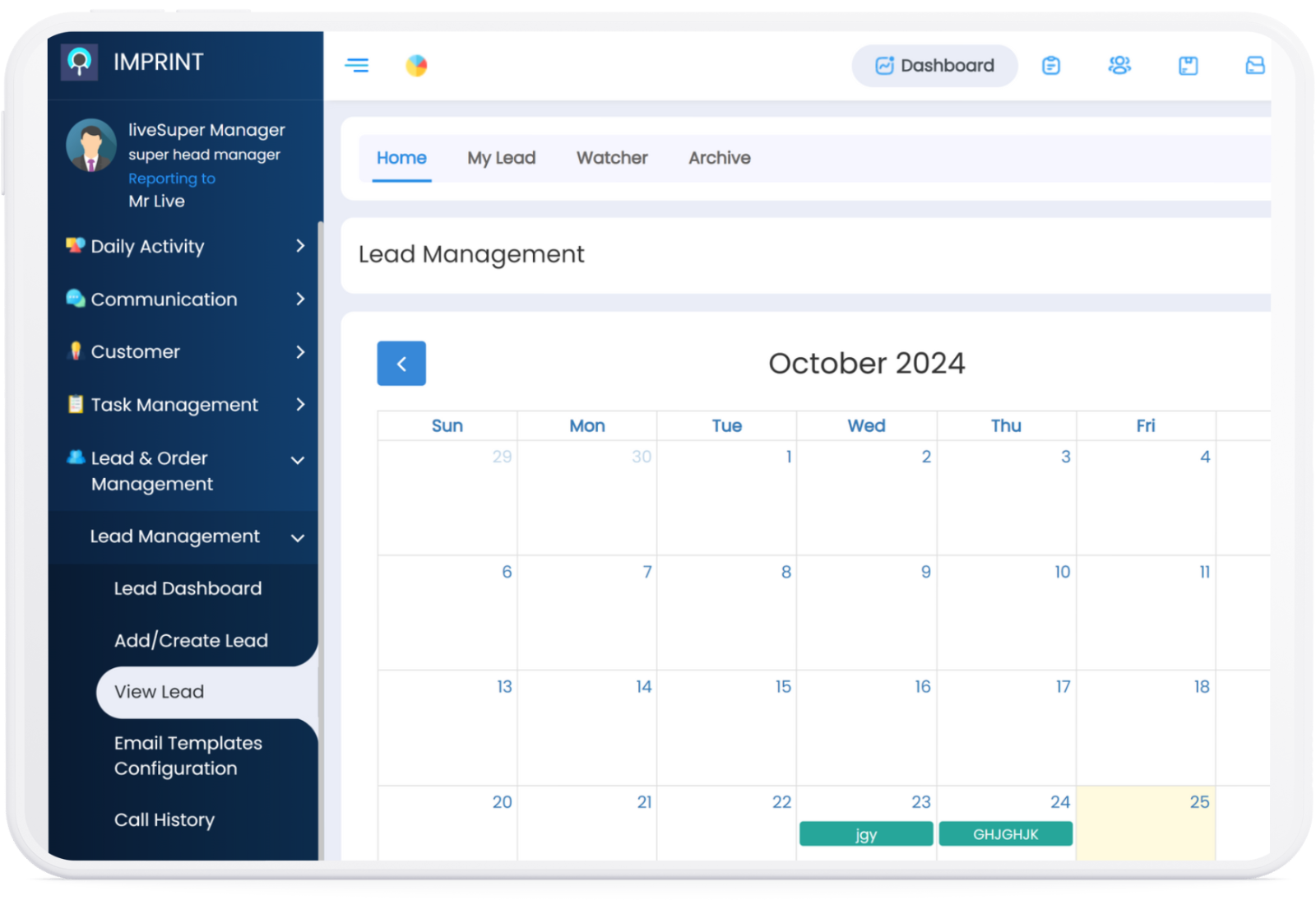

Smart Application Distribution

Automatically allocate applications to your sales reps based on various criteria, such as loan type, amount, or performance. This quick and intelligent allocation boosts efficiency and eliminates application leakage.

Timely Call Center Distribution

Seamlessly route loan applications to your call center team for timely follow-ups and status updates. This ensures that no inquiry is missed, contributing to a smooth customer experience.

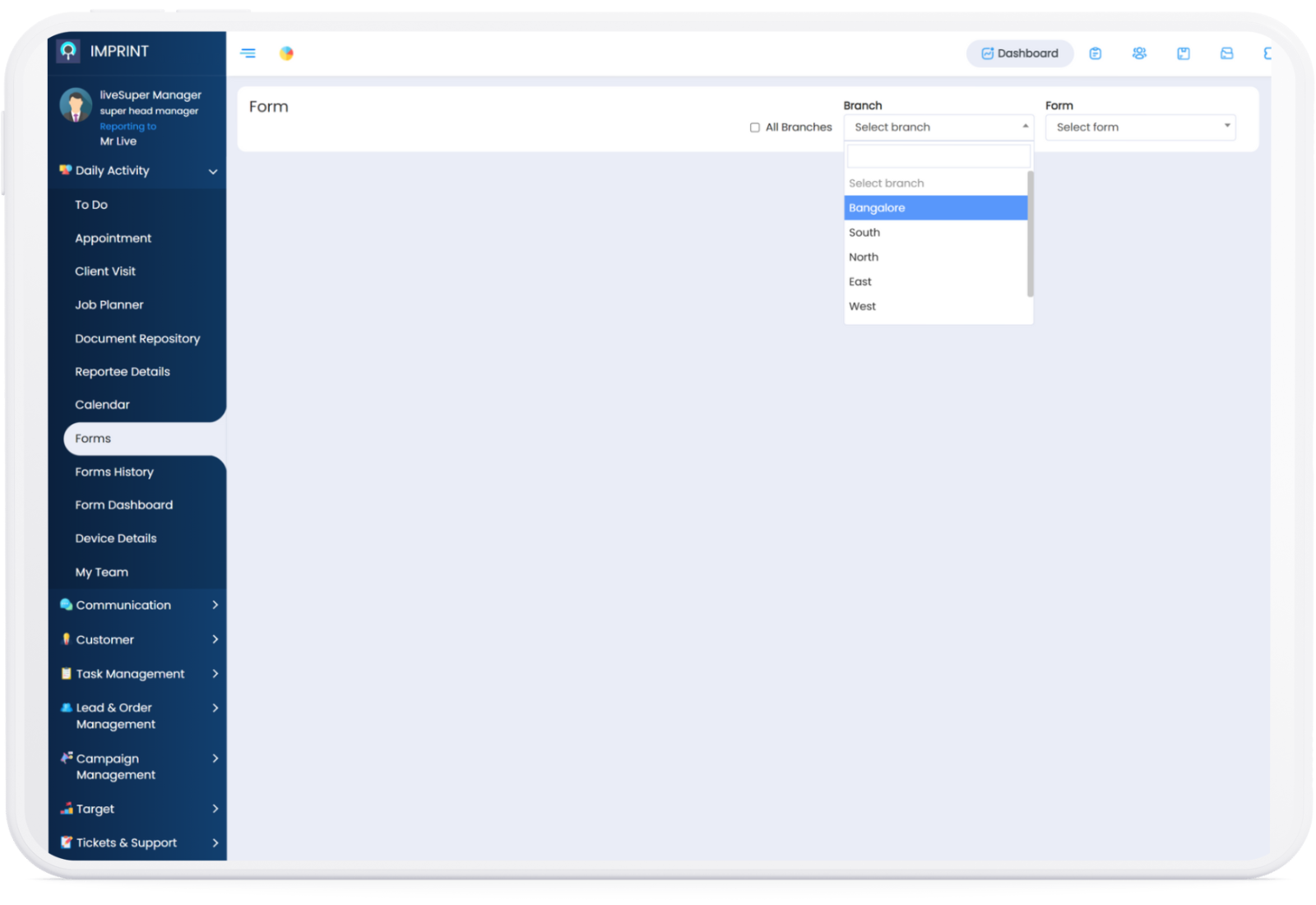

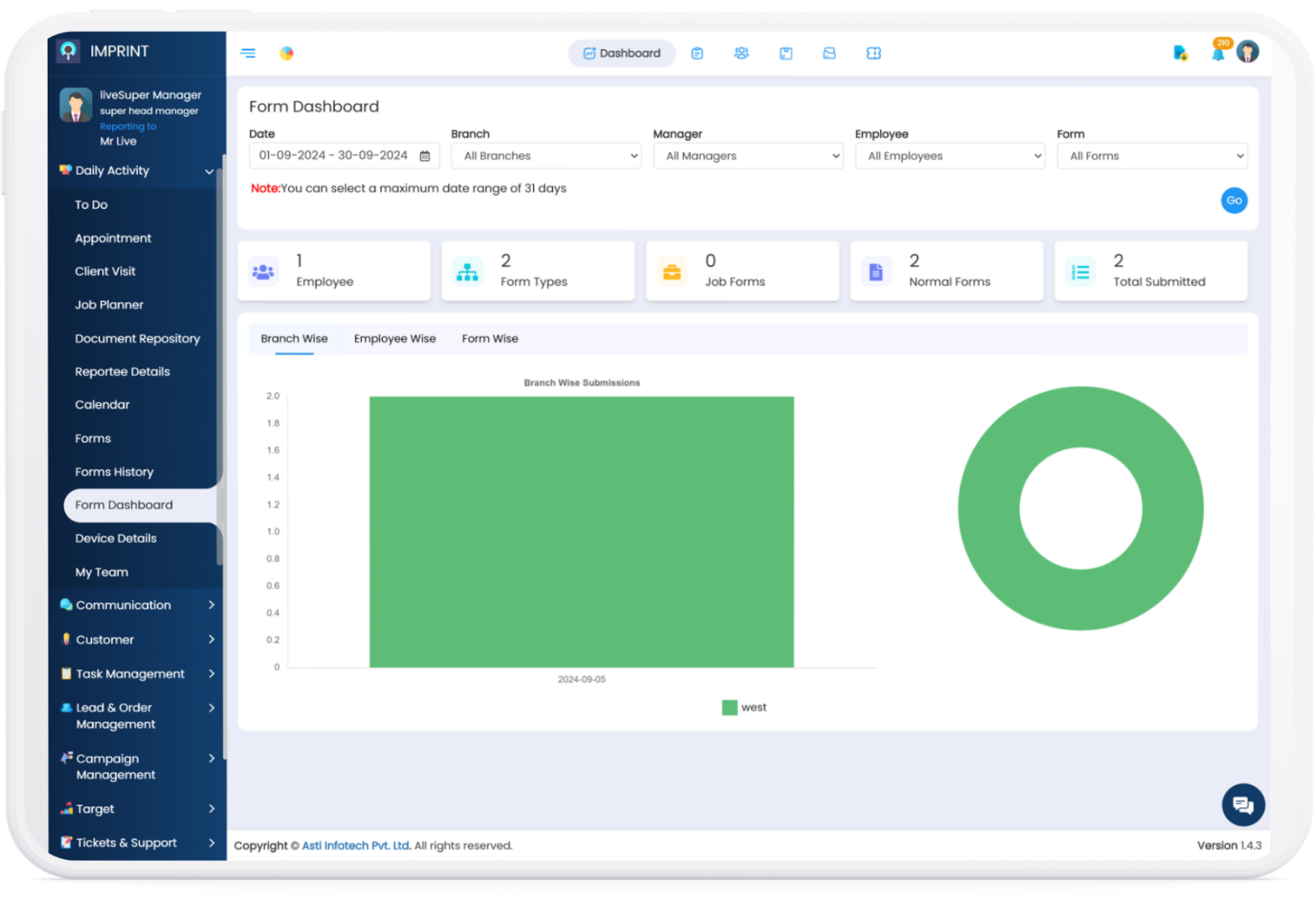

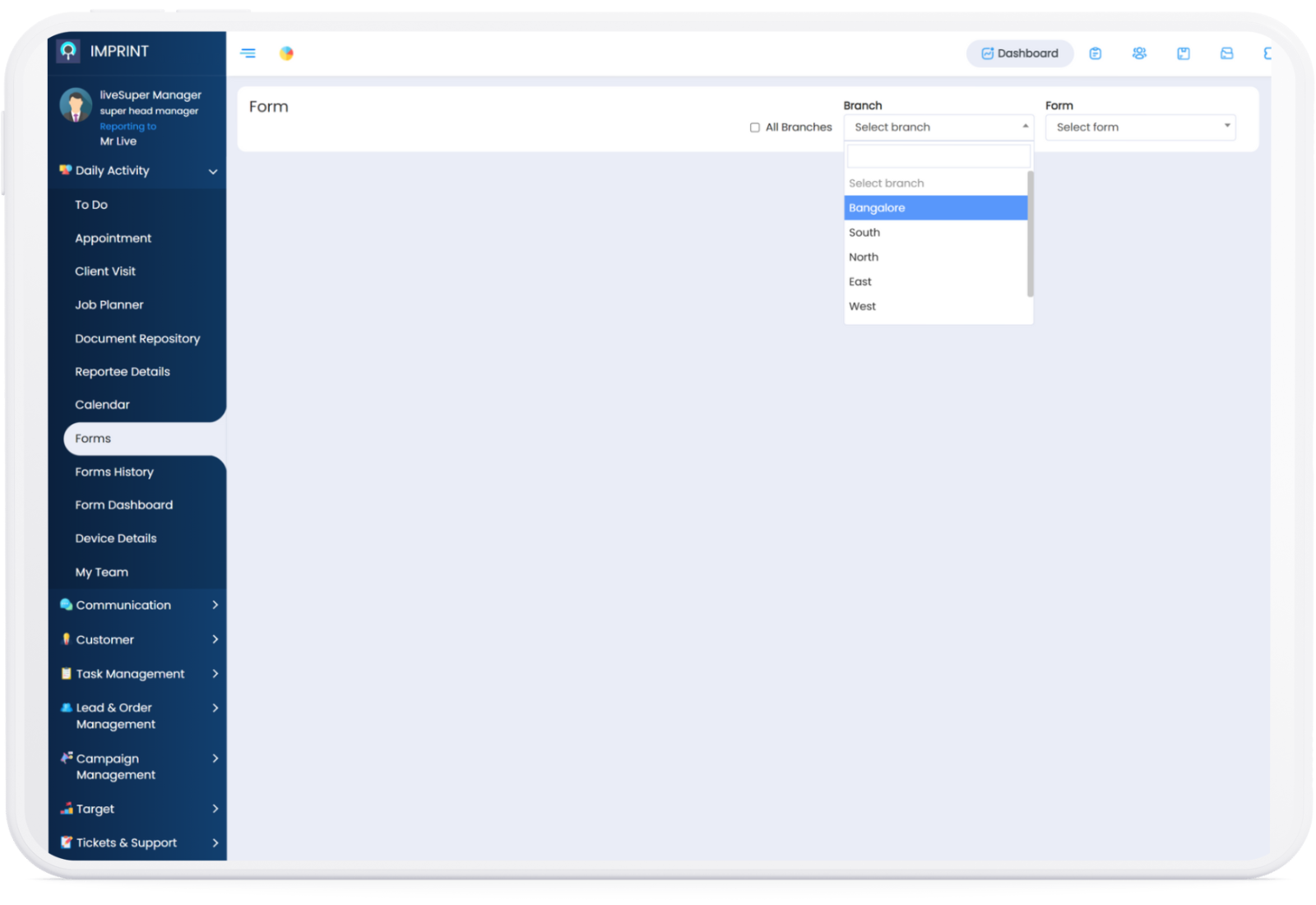

Dynamic Forms for Teams

Simplify tasks with dynamic forms that display only the necessary fields for each loan application type. This significantly reduces manual errors, speeding up the application process and improving team productivity.

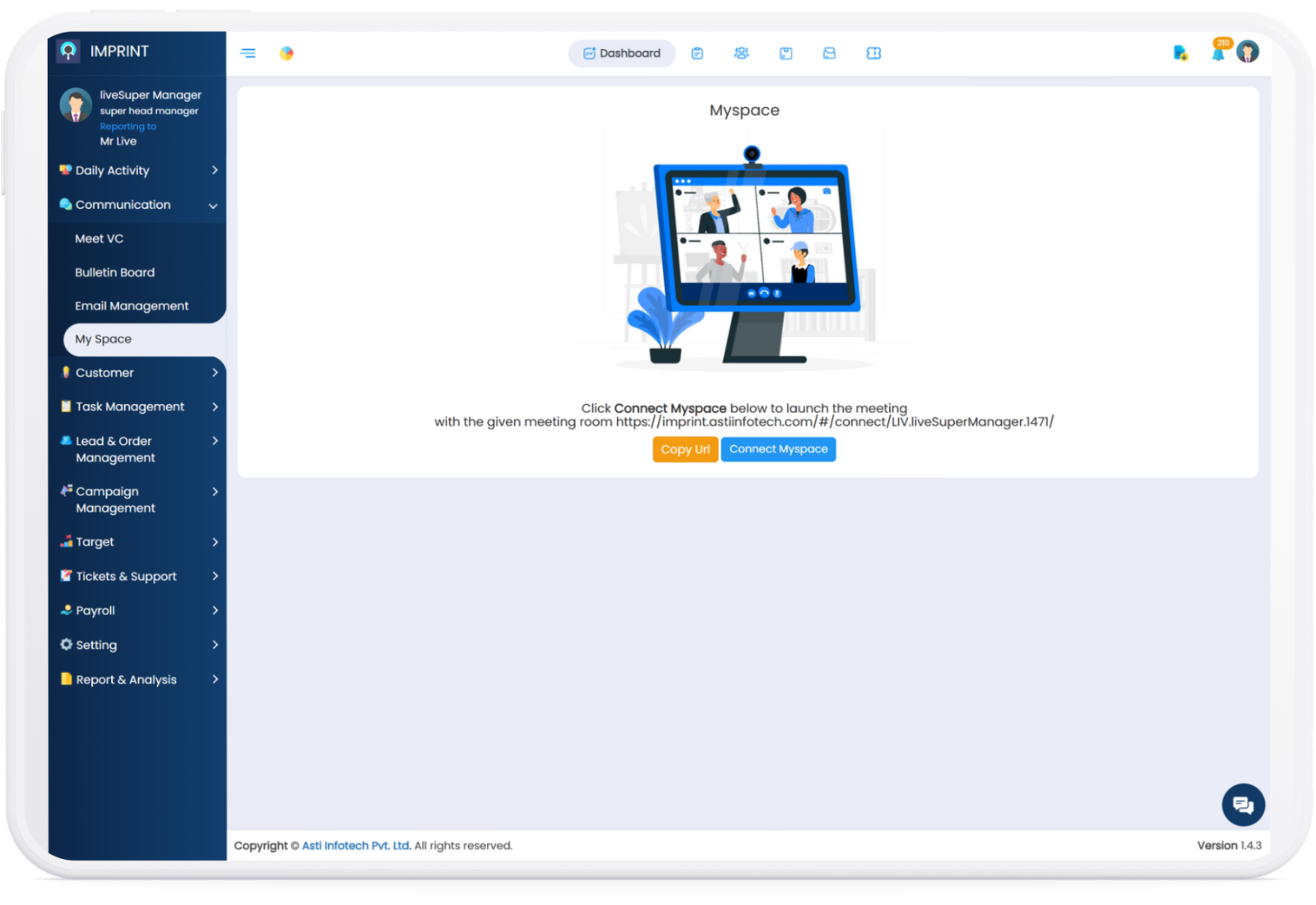

Smart Borrower Segmentation and Communication

Segment borrowers based on various factors such as application status, demographics, and financial background. Maintain relevant, personalized communication across all channels to enhance borrower engagement.

Cross-Sell Opportunity Identification

Increase customer lifetime value by identifying cross-sell opportunities. Imprint allows you to offer additional products, such as pre-approved loans, to qualified borrowers, boosting retention and profitability.

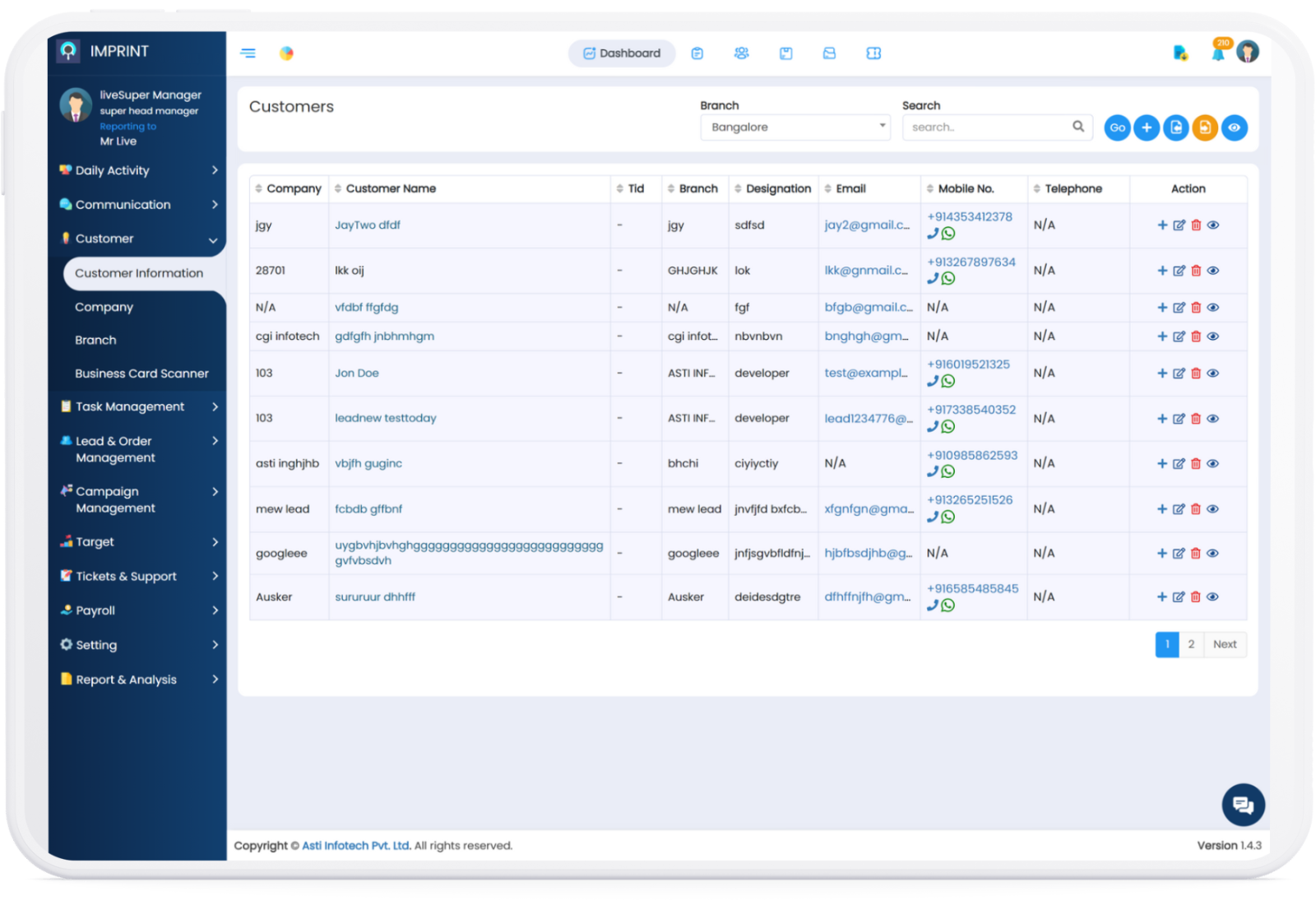

Access Borrower Info from Multiple Data Points

Leverage integrations with LOS, credit bureaus, and other financial aggregators to access vital borrower information. This automation enables faster qualification checks and tailored offer generation.

Offer Generation Engine

Generate accurate loan offers instantly, based on key borrower attributes such as income, age, and credit score. By utilizing data from borrower activity and third-party tools, Imprint ensures personalized and optimized lending solutions.

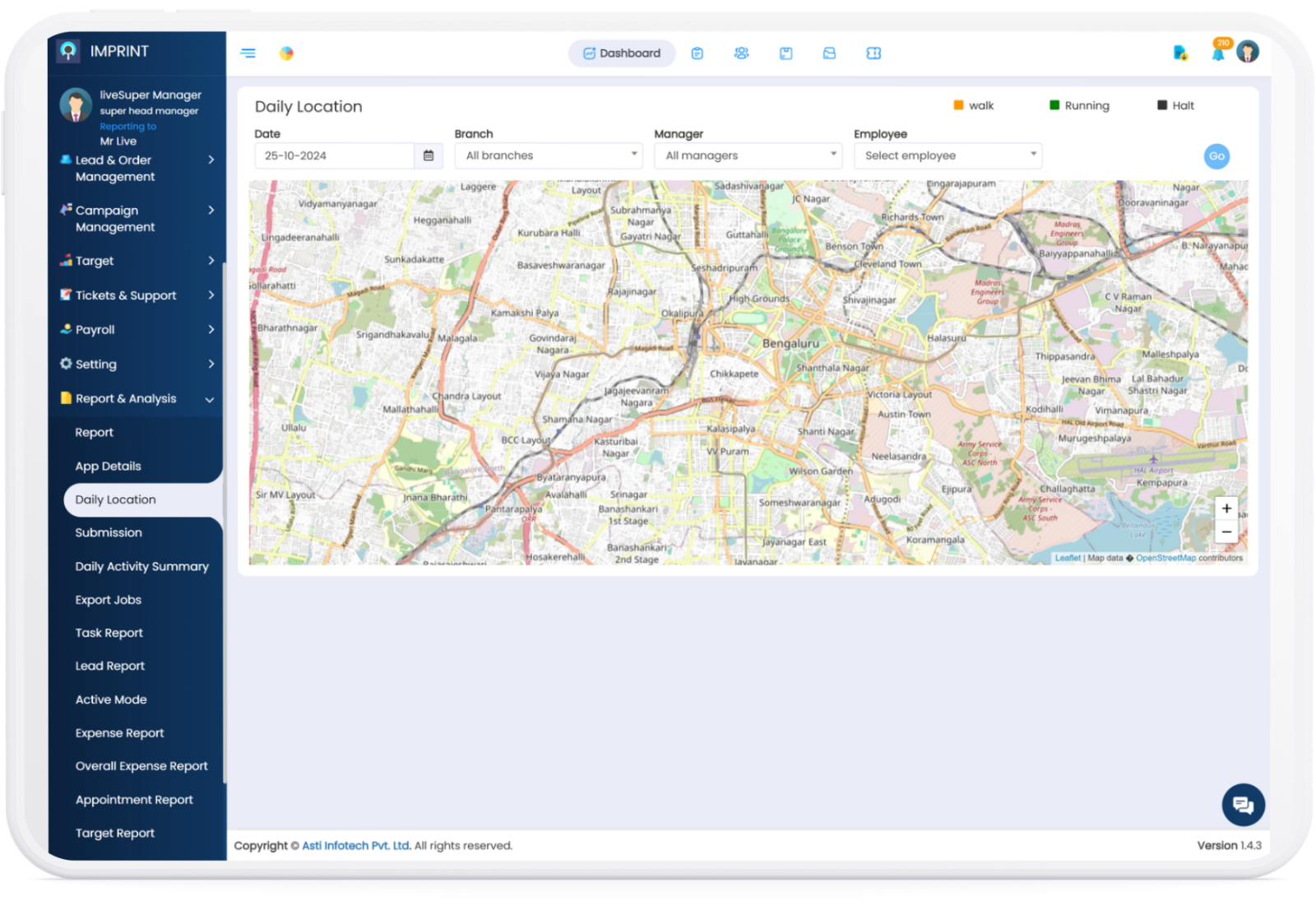

Field Force App – Agent Scheduling and Real-Time Tracking

Optimize your agents' daily schedules, prioritize tasks, and track their real-time activities through geo-tracking and auto check-ins. This feature ensures productivity, accountability, and timely borrower follow-ups.

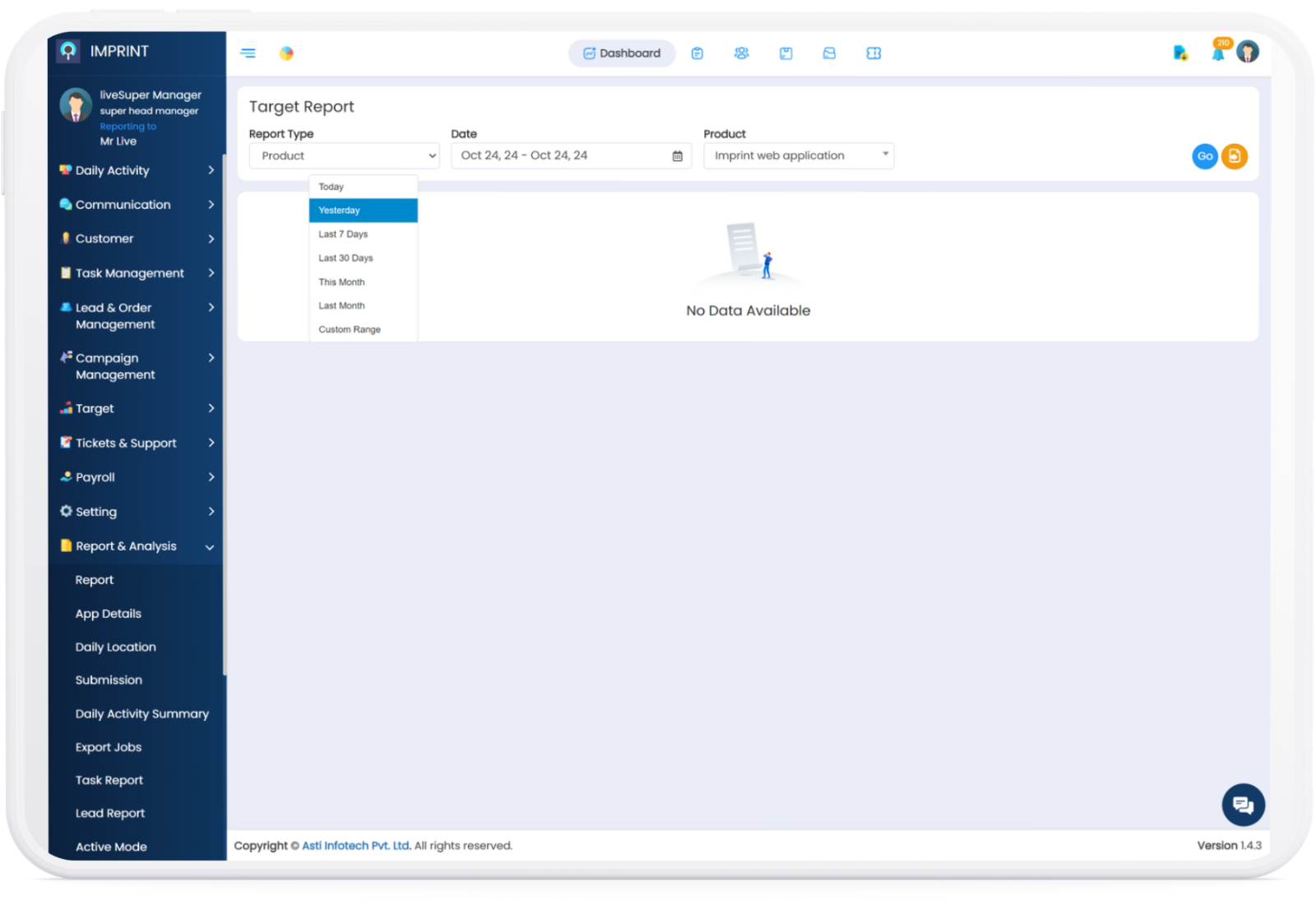

Comprehensive Performance Reporting

Access detailed performance reports for your lending products, sales teams, and field agents. By reducing borrower acquisition costs and improving operational efficiency, Imprint helps you make data-driven decisions that enhance business outcomes.